For 20 years, the bill review world has convinced insurers that approval needed to happen within bill review process. Prior to that, the approval process was all manual, but it took place BEFORE bill review.

So why are the bill review companies so adamant about doing it this way? Because they get paid based on the volume of bills in bill review. It’s not in their best interest to save you money by putting the approval process back where it should be – in front of Bill Review.

At APS, we take the garbage out before Bill Review. ClaimExpert is a data integrity tool that works before the bill review adjuster approval portal, dramatically reducing medical and expense costs beyond traditional bill review.

ClaimExpert identifies inappropriate billings before they reach bill review. These bills are returned to the providers for additional requested information validating a host of conditions before they can be paid. The vast majority of returned bills are never sent back for processing, resulting in huge savings for the client.

To illustrate how significant the savings can be, a real ClaimExpert client saved more than $113 million in just 8 years beyond traditional bill review. That’s $14.4 million in savings per year for this Self-Insured/Self-Administered employer!

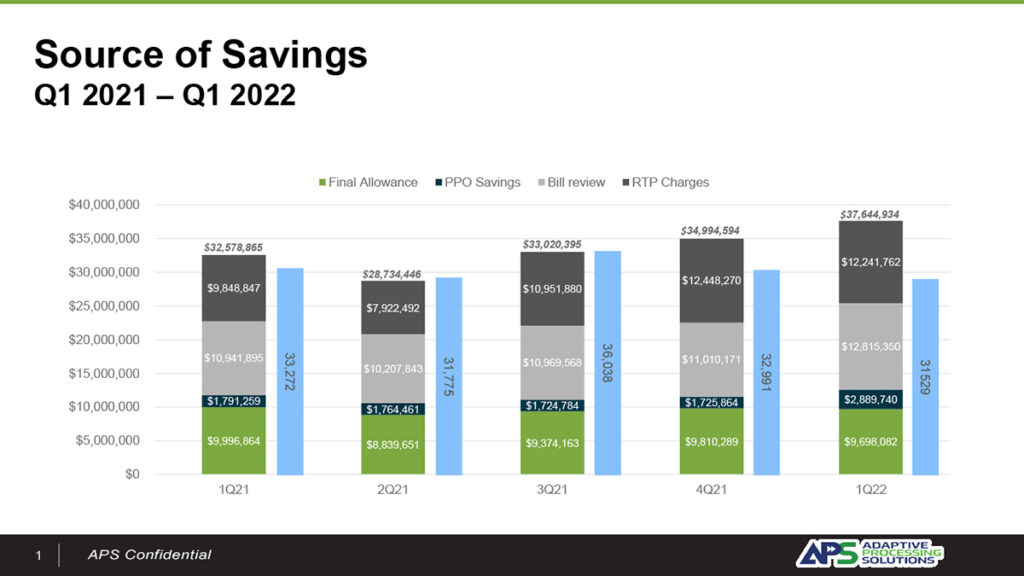

This national property casualty carrier is also saving big! During this five-quarter period, over 10,000 bills were returned to the provider, resulting in a savings of $17,627,745.67!

Almost 10,000 bills were returned to the provider throughout this five-quarter period, resulting in a savings of $17,627,745.67.

The best part is we can work with your existing bill review (or use our bill review platform), to eliminate the junk before it gets to bill review. Plus, fewer bills mean you’re saving on bill review costs, too. It’s a win-win!

APS is a comprehensive business process automation firm focused on workers’ compensation and auto casualty claims. Our end-to-end suite of claims management solutions include digital mailroom, data capture, bill review, rarity and relatedness, clearinghouse and e-payments, managing every claim from first notice of loss through payment.

To learn more about how much your company can save by putting the approval process back where it belongs – in front of bill review – visit AdaptiveProcessing.com or call 1-855-282-1476 to arrange a demonstration today.

You must be logged in to post a comment.